The proprietary, comprehensive, Life Insurance Contract Sales System from MakoLab

Details

The client is life insurance company UAB PZU Lietuva gyvybės draudimas. Its main shareholder is one of Poland’s oldest and largest insurance groups, Grupa Kapitałowa Powszechnego Zakładu Ubezpieczeń SA (PZU Group), which consists of almost thirty entities at home and abroad.

The project presented several major challenges. We were creating, developing and deploying a new, customised edition of our state-of-the-art LICOSS life insurance sales system for PZU Lietuva. We had to incorporate the migration of a decade-old system to entirely new technology and augment it with cutting-edge modules and functionalities. In addition, we were handling integration with a number of other systems, including ONDATO and a system by Asseco.

At the same time, we were developing and maintaining the first version of LICOSS, which meant working in parallel on two systems in different technologies.

Our brief was to create a system which would provide a secure, technologically advanced process for preparing and selling life insurance policies and which was designed for use by the full staff of agents, underwriters, actuaries, executives and sales managers. PZU Lietuva also required the system to generate added value in the form of reduced costs and a consistently expanding client list.

- The process of entering into a contract has been reduced from 15 days to 125 minutes

- LICOSS has enabled PZU Lietuva to generate from 1,000 to 2,000+ calculations every month

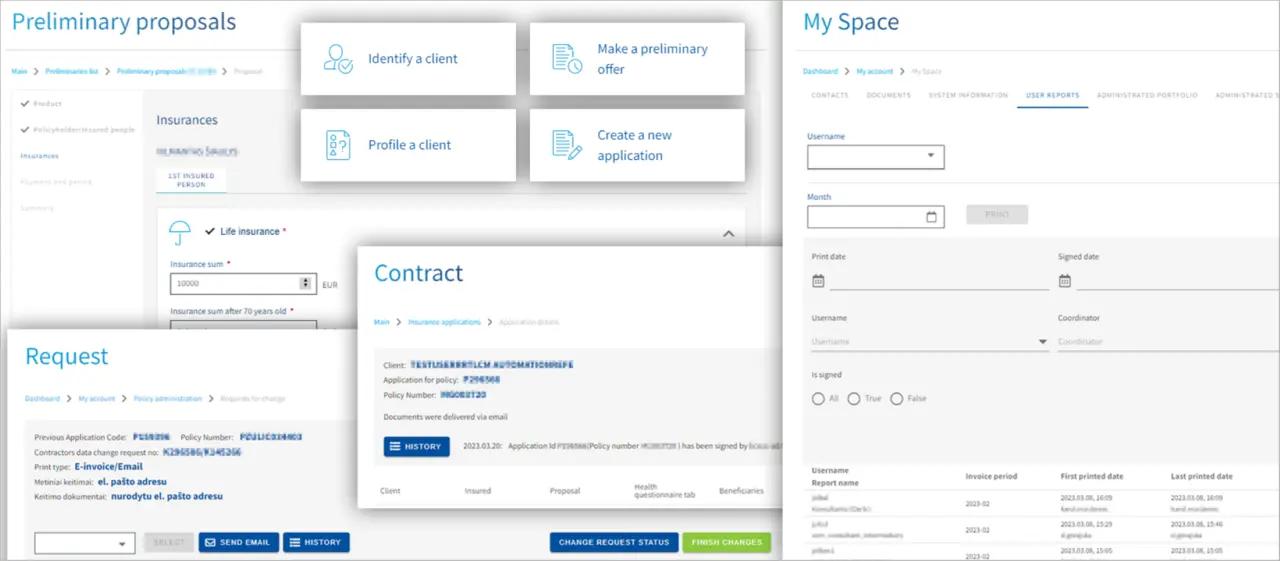

In line with PZU Lietuva’s requirements, we delivered PZU Life (LICOSS), a system which consolidated all the available products into one, multivariant solution and gave the insurance agents additional sales tools. The support it provides encompasses the entire process, from data collection and customer identification, via carrying out calculations and the many stages of the confirmation procedures, to the end product, a finalised policy.

We equipped the system with sales modules which make it possible to create, modify and manage policies. PZU Life (LICOSS) offers a wide range of functionalities. They include:

- identifying the customer and the insured person;

- carrying out calculations for various insurance products;

- using dynamic questionnaires on a range of topics, including health;

- generating full documentation;

- obtaining a doctor’s evaluation of a policy.

The built-in PZU Life (LICOSS) calculator facilitates the simulation of a range of product parameters, such as the sum insured and payment forecasts.

In tandem with the main functions of the automated life insurance sales process, the system serves as a tool for providing data sets on life insurance, which are essential to process monitoring and business analyses.

The project features the following technologies:

- Front-end: VUE.js 2 + JavaScript

- Back-end: .Net Core 3.1 REST API JWT authentication

- Database: Oracle 19c